Benefits

Agency notice compliance made simple with NOTICENINJA.Tax and Compliance Notice Chaos?

NOTICENINJA rescues your company from wasted time, expenses, and anxiety. Managers receive essential oversight and compliance reports for informed decision-making. Tailored for notice professionals, you'll stay updated on notice statuses, assigned personnel, and activity duration. Bid adieu to misplaced files and overlooked deadlines!

Corporations

PEO's & Paryoll

CPAs

.png)

Private Equity

Some additional ways NOTICENINJA makes life easier

Power of Attorney and tax document management

Mass communications

Amended return process workflow

Scan-to-capture (OCR) notice entry

Missing EIN tracking tool

Track and record calls to agencies

Import notice history

Import client data

Single sign-on

Integrate with CRM and other third-party systems

Auto-notice assignment routing

Unlimited notice types

Key Benefits

Any Notice Type

Can be used for any type of notices you manage including: Payroll, Corporate, City, Local, Property Tax, Sales and Use, and others.

Dashboard Visibility

Dashboards provide easy visibility into the status of all active notices that are being worked on the individual or group level.

Compliance Reporting

Reports at the Notice, Client, and System levels that take seconds to generate and makes compliance reporting easy to do.

Standardize Workflows

Standardized workflows ensure that all data is entered and tracked throughout the full life cycle of a notice. All users enter, track, manage and resolve notices using the same process.

Additional Fields

The system provides fields for all of the items you need to track from Received Date, Due Date, Notice Type, to Amounts Due, Refunds and much more. Additional fields can be easily added if needed

Scan-to-Capture

Scan to capture capability will allow you to enter most notices without having to manually key the data, speeding the process and reducing data entry errors.

Standardize Communications

The software comes loaded with Template Letters which are used to standardize your communications with clients, agencies, or other 3rd parties. Template letters can be easily added or modified.

Central Knowledgebase

The Agency Information section provides a central reference area where users can store and manage all of the Addresses, Contacts, Contact Info, Website Links, Notes and any other relevant information for the agencies you work with.

POA Management

Manage POAs and similar tax documents for clients or for multiple sub-entities. Store POAs at the client level, track expiration dates, and provide communication templates to request signed POAs from clients to track internally, or send to agencies when required.

“Close the Loop”

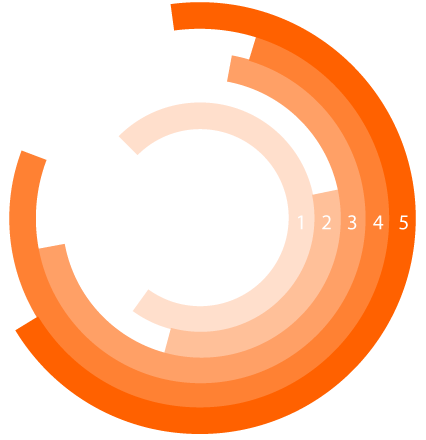

NOTICENINJA is a Digital Notice Compliance Platform that combines intuitive automated workflows, digital document management, and extensive reporting capability to help you streamline your processes, standardize your procedures, and automate your workflows.

1. Capture & Classify Data

2. Best Practice Workflow Generated

3. Auto Distribution of Task Assignments

4. Guided Resolution Pathway

5. Close Workflow

Notice Resolution Professionals

You already know how difficult the process of researching, responding to, tracking, and documenting notices from various taxing authorities can be. Our solution is designed for notice compliance professionals to streamline how you communicate and manage client notices, agency contacts, and internal teams.

.png)